Marijuana Consumer Quantitative Study Report

2020 North American Marijuana Market: Opportunities & Challenges Phase 3 - Consumer Quantitative Study Report

Marijuana Quantitative Study among 5,000 North American consumers in February/March 2020 (4,000 US consumers and 1,000 Canadian consumers).

80+ pages/slides of current analysis, commentary, and learnings with consumer knowledge, behaviors, implications, purchase insights across Marijuana CPG categories!

Site License: Includes PDF, PPT with access to charts and site rights for internal network usage across one company BRAND/location.

Price: $8,000 Order Report

The Institute's Groundbreaking Multi-Phase Research on the Impact of the Whole Cannabis Plant on Consumers

The Institute conducted a comprehensive research project surrounding cannabis. It is the first and only study to examine the impact of the whole cannabis plant — including CBD, marijuana, and hemp — and its impact on whole health across general population adults in the US and Canada.

This report represents the Phase 3 Marijuana portion of the project

Phase 1: Qualitative Study: 9 online US focus groups with consumers in October 2019 (60+ consumers). Separate Qualitative report available.

Phase 2: Industry & Market Analysis: 5-year review of cannabis-related in-market activity in November 2019. Separate report available

Phase 3: Quantitative Study: among 5,000 North American consumers in February/March 2020 (4,000 US consumers and 1,000 Canadian consumers).

Phase 3 - Table of Contents

Introduction

Methodology

Definitions of Groups

The Institute's Health & Wellness

Consumer Segments

Executive Overview of Marijuana

- Everyone is Aware of Marijuana. But Conflicting Perceptions Exist

- Usage Rates Show Upside Market Potential as Legality Grows in the US

- Clear Generational Differences Driven By Millennial's

- Forms Used Skew Toward Plant/Bud/Pre-Rolls

- Marijuana Usage

- Recreational vs Medical Marijuana Usage

- US Marijuana Word Association: Top of Mind Word Cloud

- Canada Marijuana Word Association: Top of Mind Word Cluud

- Marijuana: Consumer Level of Feeling Informed

- US Consumer Perspectives on Marijuana Social and Lifestyle Benefits

- Perceived Benefits of Marijuana

- Current Usage of Recreational Marijuana

- US-Recreational Marijuana Usage Demographic Profile

- Canada - Recreational Marijuana Usage Demographic Profile

- US - Recreational Marijuana Usage frequency by Health & Wellness Segment

- Canada - Recreational Marijuana Usage Frequency by Health & Wellness Segment

- Recreational Marijuana Usage Rates

- Recreational Marijuana Use vs Intent vs Rejection

- Familiarity with Recreational Marijuana Product Forms

- Popularity of Marijuana Products by Category

- Frequency of Recreational Marijuana Product Usage

- Recreational Marijuana Products - Trade-Off Behavior with Current Products

- US-Recreational Marijuana Products as Replacements for Other Products

- US-Conditions for Which Recreational Marijuana Would Replace OTC or Rx Medications

- Average Monthly Spending on Recreational Marijuana Product Types

- Drivers for Initial Recreational Marijuana Trial

- Initial Path to Purchase Steps for Recreational Marijuana Products

- Current Usage of Medical Marijuana

- US: Medical Marijuana Usage Demographic Profile

- Canada: Medical Marijuana Usage Demographic Profile

- US - Medical Marijuana Usage Frequency by Health & Wellness Segment

- Canada - Medical Marijuana Usage Frequency by Health & Wellness Segment

- Medical Marijuana Usage Rates

- Medical Marijuana Use vs Intent vs Rejection

- Familiarity with Medical Marijuana Product Forms

- Frequency of Medical Marijuana Product Usage

- Medical Marijuana Products - Trade-Off Behavior with Current Products

- US - Medical Marijuana Products as Replacements for Other Products

- US - Conditions for Which Medical Marijuana Would Replace OTC or Rx Medications

- Average Monthly Spending on Medical Marijuana Product Types

- Drivers for Initial Medical Marijuana Trial

- Opportunity Among Non-Users: Intent to Use Recreational or Medical Marijuana

- Conditions for Which Non-Users Would Consider Marijuana as a Therapy

- Overall Barriers to Marijuana Consumption

- Generational Differences in Barriers to Marijuana Use

- Preferred Sources for Information on Marijuana

- Influences to Persuade Marijuana Trial

- Consumer Concerns About Marijuana

- Attitudes Toward Legalization of and Freedom to Use Marijuana

- Top Purchase Influencers for Recreational Marijuana

- Projected Market Sizing for Recreational Marijuana Products

- Projected Market Sizing for Recreational Marijuana Flowers/Bud/Plant/Pre-Roll

- Projected Market Sizing for Recreational Marijuana Concentrates

- Projected Market Sizing for Recreational Marijuana Baked Goods

- Projected Market Sizing for Recreational Marijuana Gummies/Other Candy

- Projected Market Sizing for Recreational Marijuana Chocolates

- Projected Market Sizing for Recreational Marijuana Sweets

- Projected Market Sizing for Recreational Marijuana Alcohol

- Projected Market Sizing for Recreational Marijuana Non-Alcoholic Beverages

- Top Purchase Influencers of Medical Marijuana

- Barriers to Medical Marijuana Use

- Projected Market Sizing for Medical Marijuana Products

- Projected Market Sizing for Medical Marijuana Flowers/Plants/Bud/Pre-Roll

- Projected Market Sizing for Medical Marijuana Concentrates

- Projected Market Sizing for Medical Marijuana Baked Goods

- Projected Market Sizing for Medical Marijuana Gummies/Other Candy

- Projected Market Sizing for Medical Marijuana Chocolates

- Projected Market Sizing for Medical Marijuana Sweets

- Projected Market Suing for Medical Marijuana Alcohol

- Projected Market Sizing for Medical Marijuana Non-Alcoholic Beverages

- The Institute Health and Wellness Consumer Segment

- Five Distinct Segments within the Population

- Snapshot: WELL BEINGS

- Snapshot: FENCE SITTERS

- Snapshot: FOOD ACTIVES

- Snapshot: EAT, DRINK & BE MERRYS

- Snapshot: MAGIC BULLETS

Methodology - Phase 3 Quantitative Consumer Study

Scope:

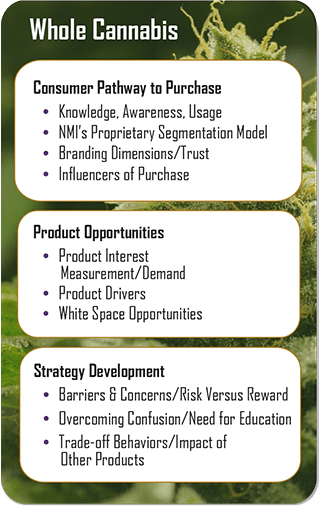

- The Institute conducted a comprehensive research project surrounding the whole cannabis plant — including CBD, hemp, and marijuana — and its impact on whole health across general population adults in North America with a focus on pathway to purchase, product opportunities, market sizing, and strategic marketing applications.

- The focus of this consumer study examined the attitudes, behaviors, motivations, and purchase interest related to the dynamic, multi-faceted dimensions of whole health, including the impact on human health and that of the planet.

Survey Methodology:

- 4,000 US adults and 1,000 Canadian adults, nationally projectable to the adult population in each country; accurate at the 95% confidence level to +/- 1.2%

- Conducted online February/March 2020

- Representative in each country to the general population of adults 18+; balanced across key demographics and nationally projectable

- Report released May 2020

Definition of Groups within the Report

GP — General Population Adults (by country)

iGen — born 1998-2001 (Ages 18-21)

Millennials — born 1977-1997 (Ages 22-42)

Young Millennials — born 1991-1997 to (Ages 22-28)

Older Millennials — born 1977-1990 (Ages 29-42)

Gen X — born 1965-1976 (Ages 43-55)

Boomers — born 1946-1964 (Ages 56-72

Matures — born 1900-1945 (Ages 73+)

CBD past 6 month users - used a CBD product* in past 6 months

CBD lapsed user — used a CBD product* but not in the past 6 months

CBD non-users — have never used a CBD product*

CBD Intenders — definitely/probably would use a 880 product* at some point in the future if available where they shop; includes consumers who have ever used CH but not in the past 6 months

All references to dollar sizes are in their local currency (US Dollars, Canadian Dollars)

*oil, tinctures, gummies, capsules, foods, topicals, other forms

The Institute's Health & Wellness consumer segmentation identifies five distinct segments within the U.S. general population