2019 STATE OF SUSTAINABILITY IN AMERICA 17th Annual Consumer Insights & Trends Report

132 pages of current consumer insights with data and analysis, including charts, graphs, illustrations!

Site License: Includes PDF, PPT with access to charts and site rights for internal network usage across one company BRAND/location.

Price: $7,500 Order Report

Introduction Summary

17 Years of Sustainability Marketplace Insights

This report is the seventeenth annual U.S. report NMI has published on the state of the sustainability market. This research uncovers insights into how today’s consumer integrates eco-friendliness into their daily life and reveals their motivations and the challenges they encounter in their pursuit to become increasingly aligned with a more sustainable lifestyle.

The report is full of insights, data, and analysis to help you better understand the ever-evolving world of environmentally-friendly, sustainable, socially conscious, and healthy products and services. In fact, sustainability-related benefits are showing growth in a number of categories across the consumer landscape. Their growth is due in part to the fact that many products and services now come with fewer and fewer trade-offs, and consumers continue to gravitate toward brands that help them live healthfully and sustainably.

This Report Provides A Comprehensive Overview Of Where The Current Sustainable Marketplace Stands, In Addition To...

- The return on investment of companies’ sustainability initiatives

- How segments within society view sustainability differently and what motivates this differentiation

- Consumer insights regarding the health of the planet and what issues resonate most

- Consumer alignment with sustainable food benefits

- The impact of Millennials

- New ways to reach and impact the new breed of ethical consumers

- And much more

Our Report profiles Consumer Trends Tracking on Sustainability

CORPORATE ROI

While many companies may find sustainable initiatives such as saving energy and reducing waste as financially beneficial, companies that are embracing sustainability as a holistic means of doing business are reaping even wider benefits among an increasingly environmental and socially conscious population.

SEEKING DEEPER VALUE

Mainstream consumers are steadily adopting stronger environmental and sustainable ideals which are affecting not only how they view brands but how they use their buying dollars to make their beliefs known.

TRANSPARENCY 2.0

Concern is prevalent regarding the state of the world and the country today and while we all are accountable for our actions, consumers look to places of authority such as governments and corporations to be doing their part to “right the ship.”

CONSUMER ENGAGEMENT

Consumers are clearly showing more sophistication within the realm of sustainability – with greater understanding of its breadth, depth, and implications, they pick the elements that mean the most to them.

ENGAGING MILLENNIALS

Millennials are important to understand not only due to their size, but because they are causing subtle adjustments in the way today’s business environment needs to function.

REQUIRED INFORMATION

Access to information and technology has created a highly discerning and sophisticated consumer. No longer satisfied with claims made by a manufacturer or service provider, skeptical consumers are now demanding impartial proof and third party verification.

DUAL POSITIONING

NMI research has shown that those who value protecting the environment are also far more likely to exercise, be a healthy weight and eat healthy or organic foods. The deepening of this linkage over time has fueled an entire industry of products and services.

PACKAGING PREDICAMENT

There is a broad shift under way at major U.S. corporations to reduce waste. The sourcing and ‘end life’ of packaging will become significantly more relevant as the product life cycle and waste impact are becoming a stronger part of consumers’ purchase decisions.

PROLIFERATION OF PLASTIC

With images of “plastic islands” growing in the oceans and plastic products destroying wildlife, it’s not surprising that consumer perception regarding plastic products has been declining while also re-shaping behavior over the past several years.

KNOW YOUR SEGMENT

Specific consumer segments in the population exhibit various shades of green that are led by the “greenest” segment, the LOHAS segment, who is integral in driving sustainability to the mainstream. LOHAS consumers are the gatekeepers and stewards of sustainable ideals.

Table of Contents

U.S. Sustainability Consumer Trends Database Overview

Definitions of Groups

Introduction

Overview: Trends in Sustainability

NMI's Sustainability Segmentation

Sustainability Segmentation Overview

Sustainability Segmentation Model Methodology

Five Distinct Sustainability Segments

Segment Composition Trended

LOHAS Consumer as Environmental Steward

Sustainability Process Explained

Sustainable Mainstream Overview

LOHAS Leaders and Followers

Early Adoption Across Leaders and Followers

Environmental Concerns among Leaders and Followers

Environmental Actions among Leaders and Followers

Investigation of Companies' Environmental Legitimacy

Attitudes Toward Purchasing E-Friendly Products

Willingness to Pay a Premium for E-Friendly Products

The LOHAS Consumer Profile

The NATURALITES Consumer Profile

The DRIFTERS Consumer Profile

The CONVENTIONALS Consumer Profile

The UNCONCERNEDS Consumer Profile

LOHAS Geographic Distribution

Demographic Summary Across Segments

Consumer Engagement

Consumers Engagement Overview

Self Perception of Personal 'Greenness'

Self Perception of Being Informed on Living 'Green'

Influencer Role on Benefits of Buying 'Green'

Personal Responsibility for Environmental Protection

Growth of Environmental Concerns

Growth of Social Concerns

Concern for Local over Global Issues

Consumer Attitudes Toward Level of E-Engagement

Role of Peer Pressure in E-Engagement

Connection of Planetary and Personal Health

Planetary Health

Planetary Health Overview

Concern for Global Warming

Minimizing Personal Impact on Global Warming Across Generations

Minimizing Personal Impact on Global Warming Across Segments

Concern about Water Issues

Interest in Companies' Water Reduction Policies

Concern for Chemicals in Agriculture

Concern for a Range of Environmental Issues

Impact of Certifications on Purchase

Concern about Product Packaging

Interest in Companies' Packaging Reduction Policies

Use of Personal Shopping Bags vs. Plastic Bags

Recycling Frequency and E-Friendly Ratings of Materials

Visible Environmental Issues vs. Non-Visible

Trust in the Environmental Protection Agency

Consumer Packaged Goods Usage

Consumer Packaged Goods Overview

Purchase Decisions Based on Impact on Sustainability

Early Adoption of E-Friendly Products

Sustainably-Based Product Choice

Interest in Purchasing E-Friendly Versions of Product Categories

Interest in E-Friendly Versions Across Generations

Skepticism Regarding Environmental Products

Suppression of 'Green' Attitudes Across Skeptical Consumers

Seeking Proof of Companies E-Friendly Claims Trended

Quality, Convenience and Price of E-Friendly Purchase

Price Sensitivity Among Category Purchasers

Willingness to Pay a Premium Among Category Purchasers

Willingness to Pay a Premium Among Demographic Groups

Interest in Purchase Natural Versions of Product Categories

Preference for Natural or Organic over Conventional

Use of Conventional, Natural and Organic Categories

Concern about Chemicals in Consumer Products

Importance Ratings of Household Cleaning Product Attributes

Importance Ratings of Personal Care Product Attributes

Growth in Importance of HH Cleaning and PC Product Attributes

Barriers to E-Friendly Product Use

Sustainable Food & Beverage

Sustainable Foods and Beverages Overview

Trended Desire for Sustainable Foods

U.S. vs. Global Food Product Launches with Ethical/Environmental Claims

Global Food Product Launches with Ethical/Environmental Claims

U.S Food Product Launches with Types of Ethical Claims

Importance Ratings of Food/Beverage Product Attributes

Use of Organic and Natural Foods Trended

Trended Attitudes Toward Organic Foods/Beverages

Use of Sustainable Types of Foods

Mainstreaming of Plant-Based Options

Best Sources of Protein

Positive Attitudes Toward Meat Products

Reduction in Meat Consumption

Use of Healthy Food Products Among 'Meat Reducers'

Reasons for Meat Reduction by Generation

Meat Reduction for Environmental and Humane Reasons

Growing Importance of Humane Animal Treatment

Use of Protein Types

Use of Plant-Based Over Meat-Based Protein

Positive Attitudes Toward Plant-Based Protein

Levels of Vegetarian Engagement

Corporate Responsibility & Action

Corporate Action Overview

Importance of a Company's Sustainable Platform Trended

Impact of a Company's Sustainability Initiatives on Purchase

Impact of Cause Marketing

Interest in a Company's Social and Environmental Initiatives

Interest in a Company's Initiatives Among Leading Edge Gen Z

Trust in Specific Groups to Protect the Environment

Skepticism of Companies' Environmental Initiatives

Certifications As Validation of a Company's E-Initiatives

Confusion Regarding 'Green' Certifications

Influencers of Sustainable Product Purchase

Concern about Socially Responsible Business

Drivers of Implementation of Sustainability Initiatives

Impact of Millennials

Impact of Millennials Overview

Size and Importance of Millennials

Millennial Spending Across Categories

Importance of Sustainability on Product Purchase Across Generations

Millennials' Early Adopting and Influencing Behaviors

Impact of a Company's Sustainability Initiatives Among Millennials

Growth in Millennials' Sustainable Purchasing

Drivers of Millennials' E-Friendly Purchases

Impact of Technology/Social Media Influencers

Millennial Health Issues

Quality of Life Perceptions Based on Previous Generations' Irresponsibility

Sustainability Consumer Segmentation Methodology

Segmentation Model: Development of NMI’s unique and proprietary segmentation model began with evaluating over 170 different attitudinal and behavioral variables, later narrowed to approximately 15. A k-means clustering method was used. Cluster centers were defined as dense regions in the multivariate space based on a k-means segmentation of the attitudinal variables from NMI’s Sustainability Consumer Trends Database survey.

This segmentation can be used to identify and predict segment membership as part of a quantitative extrapolative analysis of future consumer behavior.

5 Influencial Segments: each segment is mutually exclusive and is designed to have the maximum differentiation between consumer groups and the maximum homogeneity within each consumer group. The predictive accuracy is high at 80%.

The segmentation has been overlaid on third-party data sets such as Nielsen’s Homescan and can be used through NMI in custom/primary qualitative or quantitative research.

Definitions of Consumer Groups Within the Report

GP – General Population U.S. Adults 18+

Millennials – born 1977-1997 (Ages 21-41)

Young Millennials – born 1991-1997 (Ages 21-27)

Older Millennials – born 1977-1990 (Ages 28-41)

Gen X – born 1965-1976 (Ages 42-53)

Boomers – born 1946-1964 (Ages 54-72)

Matures – born 1900-1945 (Ages 73+)

LOHAS – a segment of consumers defined as “Lifestyles of Health and Sustainability”

LOHAS Leaders – the portion of LOHAS consumers who exhibit the highest integration into the sustainable lifestyle

LOHAS Followers – the portion of LOHAS consumers who are highly engaged in the sustainable lifestyle but show lower integration than the Leaders due to some price sensitivity and uncertainty

Sustainable Mainstream – consumers within the population that fall in the NATURALITES, DRIFTERS, or CONVENTIONAL segments who are adopting some sustainable attitudes and behaviors and feel somewhat empowered they can make a difference

High Green, Medium Green, Low Green – consumers divided into three groups based on how environmentally-friendly or "green" they feel currently with regards to how they live their life on a daily basis

Statistically Significant Differences – Throughout this report, statistically significant differences between mutually exclusive consumer segments (using t-tests) are identified with capital letters. These tests are conducted at the 95% confidence level.

Indices – Indices are used throughout this report to compare consumer groups. An index is useful for the purpose of quick comparison and is a ratio of one piece of data to another. For example, if 22% of Consumer Group A use CFL’s, and 60% of Consumer Group B use CFL’s, then the index of Consumer Group A to Consumer Group B is: (60/22) x 100 = 272, which means that Consumer Group B is roughly 2¾ times more likely to use CFL’s than is Group A.

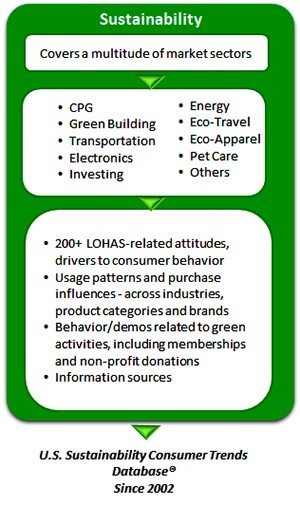

NMI U.S. Sustainability Consumer Trends Database® (SCTD) Overview

Scope:

- Quantifies the size of the consumer market for environmentally and socially responsible products and services

- Measures the importance of environmental and societal issues as well as corporate social responsibility

- Explores environmentally conscious behavior

- Determines consumer usage of sustainable products and services and quantifies purchase criteria

- Annual tracking study in U.S. since 2002 and globally since 2005

Report Methodology:

- 3,000 U.S. adults in 2018, nationally projectable to the U.S. adult population and accurate at the 95% confidence level to +/- 1.2%

- Conducted online & Crafted 4th Quarter 2018, Report released January 2019

NMI Databases:

- U.S. Trending since 2002 and Globally since 2005

- 54,000+ U.S. consumers in database

- Conducted in 23 countries; 150,000+ global consumers interviewed

Reaching the Target

- Throughout this report, it will become clear that while it is important to understand how best to reach your target audience it is also important to understand what sustainability message you are trying to communicate. Without such connection, strategies can be misaligned.

- If your product or service is not inherently sustainable or considered ‘green,’ but the organization is taking part in social or environmental programs, this can be a viable approach to take part in the market.

- Social networking is almost a must for any marketing eco-campaign as it allows messages to spread quickly and also is an effective way to gain consumer feedback almost immediately. As indicated on the following pages, specific targets resonate more than others.

- Regardless of the method used, it is important to get a trustworthy message out through any and all means available. And as will be shown, consumers want relevant, meaningful and proven eco-benefits for such.

- As consumer attitudes and behaviors surrounding sustainability continue to grow, companies involved in the green and sustainable marketplace should also see a growth in return on investment.

- The basis for ‘reaching the target’ is NMI’s Sustainability segmentation which is covered in depth, along with generational cohort insights and other consumer groups as relevant to the topic.

For more information, kindly contact Steve French.