2024 Supplements OTC Rx Consumer Trends Report

141 pages of the Institute’s research, study supported, providing current consumer insights with data and analysis, including charts, graphs, and illustrations!

Site License: Includes PDF, PPT with access to charts and site rights for internal network usage across one company BRAND/location.

Price: $15,000 Order Report

Introduction: 11+ Years of Supplements-OTC-Rx (SORD) Marketplace Insights

Natural Marketing Institute is pleased to present its 2024 Supplements/OTC/Rx (SORD) Consumer Trends Report. With 16+ years of trended data, this report provides insights into the changing supplement landscape with the most recent and updated information on how consumers are thinking and behaving with regard to supplements. In addition, it uncovers the health challenges consumers encounter and how their behaviors and attitudes surrounding supplement usage have transformed, adjusted, and realigned over the past decade in response to the ever-changing world and the current inflationary environment.

In this report, it is our aim to provide the insights into what may lie ahead and the perspective on the trends within the supplement industry from a consumer point of view. It also intends to maximize client learnings and opportunities in terms of attracting new consumers, increasing compliance and developing compelling messaging and communications strategies.

Some of the topics covered in this report:

- How supplement use is changing due to the current state of the economy

- Emerging opportunities surrounding women’s health

Barriers Supplement Users encounter when using supplements - Importance of certifications and which are more likely to drive supplement purchase decisions

- White space opportunities for supplements and condition management

- …Plus many others

Table of Contents

Database Overview

Other Natural Marketing Databases Used

Definitions of Groups

Introduction

Executive Summary

Overall Trends

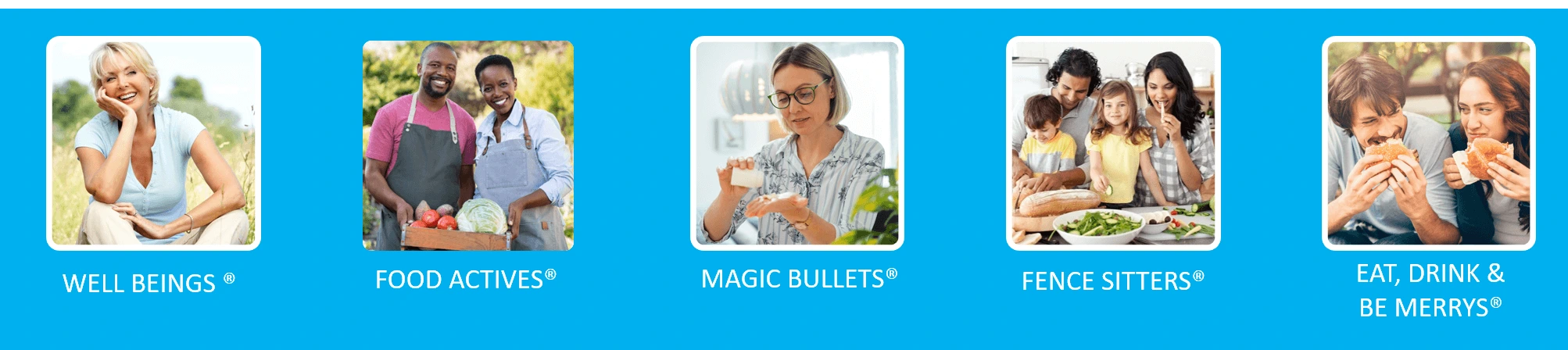

Health & Wellness Consumer Segments

Natural Marketing Institute's Consumer Segmentation Methodology

Segment Overview

Importance of Daily Supplementation

WELL BEINGS Snapshot

FOOD ACTIVES Snapshot

MAGIC BULLETS Snapshot

FENCE SITTERS Snapshot

EAT, DRINK & BE MERRYS Snapshot

Importance of Weight Maintenance & Exercise

Importance of Environmental Health

Importance of Vitamins and Herbal Use

Supplement Use for Condition Management

Daily Quantity of Supplements Used

Supplement Quality vs. Price

Preference for Organic and Natural

Health & Wellness Nielsen Overlay Methodology

Nielsen's Dollars Per Buyer Index: A Segment Sample

Health & Wellness Composition of Supplement Groups

Demographic Profile of Health & Wellness Segments

What is Trending in the Supplement Landscape

Impact of Inflation on Supplement Purchase

Lowered Supplement Use and Tradeoff Behavior due to Economy

Buying in Bulk and Buying on the Internet

Switching to Store Brands

Brand Loyalty vs. Quality vs. Price

Growth in Current, Lapsed and Non Supplement Users

Growth in Current and Lapsed Usage across Generations

Shifts among Light, Medium & Heavy Supplement Users

Demographic Profile of Light, Medium, Heavy Users

Growth of Supplement Categories

Trended Use of Supplement Categories

Likelihood to Use Supplements for Specific Conditions

Likelihood to Use Supplements for Niche Conditions

Growth in Likelihood to Use Supplements for Specific Conditions

Most Important Conditions in Consumers' Lives

Reasons for Not Using Supplements

Factors Which Help Drive Supplement Use

Important Attributes toward Supplement Purchase

Preference for Organic, Natural & Sustainable Sourcing

Importance of Supplement Brands' Sustainable Initiatives

Importance of Plant-Based & Vegetarian Supplements

Preference for Supplement Packaging Types

Importance of Ingredients Sourced from U.S.

Concern Regarding Counterfeit Supplements

Recognition of Certifications

Impact of Certifications on Supplement Purchase

Importance of a Physician's Recommendation

Physician's Influence on Supplement Purchase

Overcoming Barriers to Supplement Use

Level of Confidence in Using Supplements

Issues when Using Supplements

Issue: Uncertainty of Mechanism-of-Action

Issue: Concern about Absorption

Issue: Uncertainty about Needed Nutrients

Issue: Quantity of Supplements Required to Take

Issue: Difficulty Swallowing Pills

Preference for Alternative Supplement Formats

Preferred Supplement Formats across Age Groups

Use of Gummy-Type Supplements

Pros & Cons of Using Gummy-Type Supplements

Use of Specific Supplements and Reasons for Use

Use of Specific Supplements

Opportunities for Emerging Ingredients

Growth in Use of Specific Supplements across Age Groups

Likelihood to Use Probiotics for Specific Conditions

Reasons for Use of Specific Supplements (1 of 3)

Reasons for Use of Specific Supplements (2 of 3)

Reasons for Use of Specific Supplements (3 of 3)

Use of Condition Specific Supplements

Health Condition Management and Growth

Belief in Supplement Use for Condition Management

Condition Management & Growth - 30+ Conditions

Conditions Managed across Age Groups

Age Groups Responsible for Growth in Condition Management

Methods Used to Manage Health Conditions

Health Conditions for+E60 which No Methods Are Used to Manage

Most Important Health Issues in Life Right Now

Most Important Health Issues in Life Right Now among Managers

Management of Digestive Issues

Management of Mental Focus and Memory

Affect of Stress on Brain Function

Management of Stress & Anxiety

Management of Stress & Anxiety across Age Groups

Methods Used to Manage Stress & Anxiety

Specific Supplements Used to Manage Depression

Management of Immune Issues

Methods Used to Manage Immunity

Management of Joint Pain & Arthritis and Supplements Used

Concern and Management of Female Hormonal Issues

Likelihood to Use Supplements for Specific Hormonal Issues

Trended Weight Management and Methods Used to Manage

Trended Weight Management across Age Groups

Management of Fatigue and Methods Used to Manage

Management of Sleeplessness and Specific Supplements Used

Opportunities within the Herbal Supplement Landscape

Use of Herbal Supplement Category - Trended

Use of Specific Herbals among Herbal Users

Use of Specific Herbals- Trended

CBD/Hemp Use and Reasons for Use

Use of Specific Adaptogens across Age Groups

Use of Medicinal Mushrooms and How They Are Used

Reasons for Use of Medicinal Mushrooms

Use of Lion's Mane, Maca and Saffron

Use of Saw Palmetto across Demographic Groups

Use of Elderberry & Echinacea

Use of Algae & Seaweed

Use of Specific Herbals for Joint Health Issues

Use of Cranberry Supplements - Trended

Demographic and Psychographic Profile of Herbal Users

Channels Where Herbal Users Shop

Pathways to Purchase

Channels Shopped for Supplements

Channels Shopped for Supplements by Generations

Shopping on the Internet for Supplements - Trended

Shopping on Amazon for Supplements - Trended

Perceived Trustworthiness of Specific Channels

Perceived Trustworthiness of Specific Channels across Demographic Groups

Retailers Shopped for Supplements

Monthly Spending on Supplements

The Natural Marketing Institute's Health and Wellness Segmentation Model Methodology

Development of the Institute’s Health & Wellness segmentation model began in 2009 with evaluating over 515 different attitudinal and behavioral variables, later narrowed to approximately 19.

A k-means clustering method was used. Cluster centers were defined as dense regions in the multivariate space based on a k-means segmentation of the attitudinal and behavioral variables from the Institute’s Health & Wellness Consumer Trends Database survey.

- This segmentation can be used to identify and predict segment membership as part of a quantitative extrapolative analysis of future consumer behavior.

- 5 Unique Segments: each segment is mutually exclusive and is designed to have the maximum differentiation between consumer groups and the maximum homogeneity within each consumer group. The predictive accuracy is high at 92.2%.

- The segmentation has been overlaid on third-party data sets such as Nielsen’s Homescan and can be used through the Institute in custom/primary qualitative or quantitative research.

Supplements-OTC-Rx Database (SORD) and Report Methodology

- Most comprehensive data and robust data collection vehicle available which examines the intersection of dietary supplements, OTC, and pharmaceuticals

- Ongoing consumer research among U.S. general population adults

- Nationally representative sample of the U. S. population statistically valid at 95% confidence level to +/- 1.2%

- Research previously conducted and trended in USA in 2006, 2009, 2011, 2013, 2015, 2017, 2018, 2020, 2021, 2022, 2023

- 2023 research was conducted among 3,564 general population consumers and conducted in 4th quarter 2023

- Conducted via on-line methodology

- Fielded: 11/2/23 – 11/17/23

- Trended research also conducted globally in 13 countries

Contact Us for more information on our 2024 Supplements-OTC-Rx Consumer Trends Report