9th Edition, 2021 Supplements/OTC/Rx Consumer Trends & Insights Report

133 pages of the Institute’s research, study supported, providing current consumer insights with data and analysis, including charts, graphs, and illustrations!

Site License: Includes PDF, PPT with access to charts and site rights for internal network usage across one company BRAND/location.

Price: $15,000 Order Report

Introduction Summary

Natural Marketing Institute® is pleased to present its 2021 Supplements/OTC/Rx Consumer Trends Report. The Institute has been tracking supplement usage for the past 15 years. It is our aim to provide you with the most recent and updated information on how consumers are thinking and behaving with regards to supplements, prescription, and over-the-counter medications. This comprehensive report also seeks to provide insights into how today’s consumer is confronting their own health and wellness. In addition, it uncovers the health challenges consumers encounter and how their behaviors and attitudes surrounding supplement usage have transformed, adjusted, and realigned over the past decade in response to the ever-changing and uncertain world.

The year 2020 introduced a variable into the health landscape which no one could predict. When viewing trends within this report, it is important to note that the current 2020 study was fielded in September of 2020. Therefore, the data collected in 2020, compared to previous years, may reflect changes due to the impact of the COVID-19/Coronavirus pandemic. Many of these changes may be permanent shifts in consumers’ attitudes, some may be temporary.

In this report, it is our aim to provide the insights into what may lie ahead and provide perspective on the trends within the supplement industry from a consumer point of view.

Some of the topics covered in the report:

- The impact of the COVID-19 pandemic on supplement use

- Emerging trends and opportunities surrounding immunity and digestive health

- White space opportunities for supplements and condition management

- Issues Supplement Users encounter when using supplements

- Desire for personalized supplementation

- Importance ratings of supplement attributes

- Willingness to pay a premium for certain supplement attributes

- Plus many others...

Table of Contents

Database Overview

Definitions of Groups

Introduction

Executive Summary

Trends & Opportunities

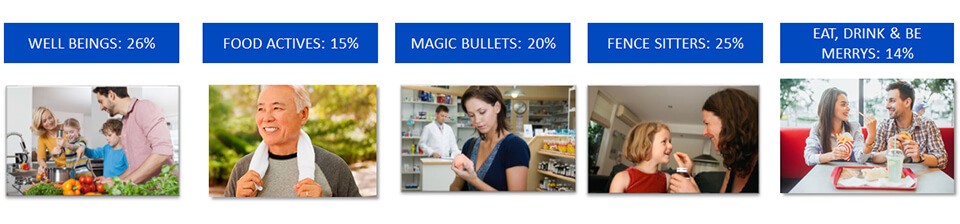

Five Consumer Segments

The Institute’s Consumer Segmentation Methodology

Segment Overview

WELL BEINGS Snapshot

FOOD ACTIVES Snapshot

MAGIC BULLETS Snapshot

FENCE SITTERS Snapshot

EAT, DRINK & BE MERRYS Snapshot

Segment Composition of Supplement User Groups

Segment Use of Supplements to Manage Health

Demographic Profile of Segments

Supplement Overview

Importance of Supplementation for Health

Supplementation for Dietary Health Assurance

Size of Supplement User Groups

Trended Growth of Supplement User Groups

Trended Demographic Composition of User Groups

Household Member Usage of Supplements

Trended Use of Supplement Categories

Detailed Trended Use of Supplement Categories

Trended Size of Light, Medium, and Heavy Users

Reasons for Increased Use

Reasons for Decreased Use

Future Use of Supplements

Trended Supplement Spending

Ratings of Effectiveness & Safety of Supplements

Issues When Using Supplements

Reasons for Non-Use among Lapsed and Non-Users

Influencers of Supplement Initiation

Use of Specific Supplements

Perceived Nutrient Deficiencies

Use of Specific Supplements in Past 30 Days-Tier 1

Use of Specific Supplements in Past 30 Days -Tier 2

Specific Supplement Use across Generations

Trended Use of Supplements-Past 5 Years

Metrics: Use of Zinc

Metrics: Use of Antioxidants

Metrics: Use of Collagen

Metrics: Use of CBD/Hemp Oil Use

Managing Health Conditions

Likelihood to Use Supplements for Condition Management - Top Tier

Likelihood to Use Supplements for Condition Management - Second Tier

Likelihood to Use Supplements for Condition Management - Trended

Current Condition Management

Growth of Condition Management

Management of Pain Issues

Methods Used to Manage Conditions-Tier 1

Methods Used to Manage Conditions-Tier 2

White Space Opportunities for Condition Management

Growth in Condition Specific Supplement Use

Blue Light Opportunity

Inflammation Opportunity

Emotional Issues Opportunity

Beauty from Within Opportunity

Sports/Nutrition Use

Concern about Condition Prevention

Growth in Concern about Condition Prevention

Concern about Preventing Conditions vs. Management

Perceptions of Supplement Effectiveness for Management

Growth of Perceived Effectiveness

Quadrant Analysis: Effectiveness vs. Concern over Prevention

Market Opportunities Revealed by Quadrant Analysis

COVID-19 & Immunity

Concern for Family's Health due to COVID-19

Change in Supplement Use due to COVID-19

Use of Supplements for Immunity & Flu

Ratings of Nutrient Effectiveness for Immunity

Supplements Used for Immunity, Flu &COVID-19

COVID-19 Effect on Emotional States

Condition Management among Immune Managers

Importance of the Microbiome

Perceived Importance of the Microbiome

Use of Supplements for Digestive Issues

Reasons for Digestive Supplement Use

Trended Use of Digestive Supplements

Probiotic & Prebiotic Use

Demographic Profile of Probiotic/Prebiotic Users

Management of Digestive Issues

Management Methods for Digestive Issues

Condition Management among Digestive Managers

Probiotic Use for Condition Management

Supplement Attribute Importance among Probiotic/Prebiotic Users

Supplement Content, Format, Sourcing

Attribute Importance among Supplement Users-Tier 1

Attribute Importance among Supplement Users- Tier 2

Growth of Attribute Importance

Attribute Importance across Generations

Supplement Format Preference

Sustainable Sourcing Preference and COVID-19

Plant-based & Vegetarian Preference

Concern over False Ingredient Claims

Influencers of Supplement Use

Sources of Influence for Supplement Purchase

Sources of Influence for Supplement Purchase among Generations

Supplement Discussions with Physician

Certification Recognition

Value of Certifications Toward Purchase

Relevance of Bioavailability

Desire for Personalized Supplements

Factors Influencing Premium Pricing

Brand Loyalty vs. Price

Supplement Shopping Behaviors

Supplement Channel Shopping

Demographics of Shopper Types

Spending across Channels

Store Brand Supplements vs. National Brands

OTC & Rx

OTC Products Used in Past 6 Months

Growth of OTC Use

Condition Managers Use of OTC

Concerns Regarding Over the Counter Medications

Trended Spending on OTC Across Generations

Conditions for Which a Prescription Medication Was Used

Growth in Use of Prescription Medications for Condition Management

Concerns Regarding Prescription Medications

Condition Managers Use of Prescription Medication

Trended Spending on Rx Across Generations

Understanding the Institute’s Health & Wellness consumer segmentation within the U.S. general population allows marketers to optimize their target products and messages

Definitions of Consumer Groups within the Report

GP - General population U.S. adults (18+)

USERS

Supplement Users - Used any supplement in past 30 days or prior to past 30 days

Current Supplement Users - Used any supplement in the past 30 days

Lapsed Users - Used any supplement but not in the past 30 days

Non-Users - Have not used supplements in past 30 days or prior to past 30 days

Light Users - Current supplement users using 1-2 supplements/day

Medium Users - Current supplement users using 3-5 supplements/day

Heavy Users - Current supplement users using 6 or more supplements/day

Herbal Users - Used herbal/botanical supplements in the past 30 days

Pet Users - Dog, cat, other pet use supplements

GENERATION SUPPLEMENT USERS

iGen Users – Born 1998-2000 (Age: 18-22) and used any supplement in past 30 days or prior to past 30 days

Millennial Users – Born 1977-1997 (Age: 23-43) and used any supplement in past 30 days or prior to past 30 days

Gen X Users – born Born 1965-1976 (Age: 44-55) and used any supplement in past 30 days or prior to past 30 days

Boomer Users – Born 1946-1964 (Age: 56-74) and used any supplement in past 30 days or prior to past 30 days

Mature Users – Born before 1946 (Age: 75+) and used any supplement in past 30 days or prior to past 30 day

MANAGERS

Heart Managers – Managing heart disease, high cholesterol, high blood pressure/hypertension

Digestive Managers – Managing digestive problems, acid reflux/heartburn, indigestion, intestinal irregularity/constipation, irritable bowel syndrome

Immune Managers – Managing cold & flu, immunity boost

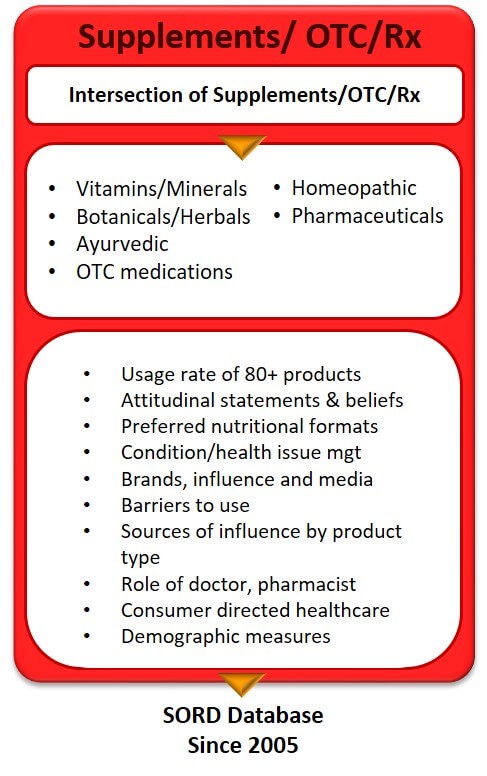

Supplements/OTC/Rx Database (SORD) & Report Methodology

- Most comprehensive data and robust data collection vehicle available which examines the intersection of dietary supplements, OTC, and pharmaceuticals

- Ongoing consumer research among U.S. general population adults

- Nationally representative sample of the U. S. population statistically valid at 95% confidence level to +/- 1.2%

- Research previously conducted and trended in USA in 2006, 2009, 2011, 2013, 2015, 2017, 2018

- 2020 research was conducted among 2,000 general population consumers and conducted in 4th quarter 2020

- Conducted via on-line methodology

- Trended research also conducted globally in 13 countries

For additional Insight & Opportunities, kindly contact Steve French, Chief Operating Officer.