2020 STATE OF SUSTAINABILITY IN AMERICA 18th Annual Consumer Insights & Trends Report

122 pages/slides of current consumer insights with data and analysis, including charts, graphs, illustrations!

Site License: Includes PDF, PPT with access to charts and site rights for internal network usage across one company BRAND/location.

Price: $12,500 Order Report

OVERVIEW INTRODUCTION

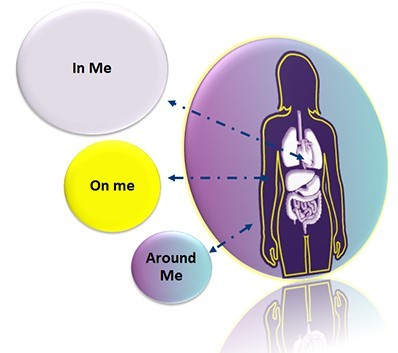

10 years ago, Natural Marketing Institute research showed evidence that consumers exhibited a hierarchy where "in me" was the most important aspect of living a healthy lifestyle, followed by "on me" and then "around me"

- It appears we are at a pivotal point where “around me” is gaining ground in the hierarchy

- We see this movement of “around me” picking up steam across categories, personal behavior and corporate initiatives

18 Years of Sustainability Marketplace Insights

This report is the eighteenth annual U.S. report Natural Marketing Institute has published on the state of the sustainability market. This research uncovers insights into how today’s consumer integrates eco-friendliness into their daily life and reveals their motivations and the challenges they encounter in their pursuit to become increasingly aligned with a more sustainable lifestyle.

Consumers are displaying an increasing understanding of the breadth of sustainability issues, the vernacular that comes with the space, and an eagerness to incorporate it into their lives. In addition, in this year’s research we are finding a heightened awareness and concern over the health of the planet which appear to be causing shifts in consumer attitudes. Instead of adopting environmentally-friendly behaviors for more self-directed health benefits, consumers are looking outward to the environment around them and realizing they have to take a bigger part in fixing the ills that are disrupting planetary health.

This report provides a comprehensive overview of where the current sustainable marketplace stands. It is this knowledge and insight that provide the basis for identifying and uncovering opportunities in the sustainability marketplace.

In addition, the report includes...

- How segments within society view sustainability differently and what motivates this differentiation

- Consumer insights regarding the health of the planet and what issues resonate most

- Consumer alignment with ethical eating

- How the iGen generation views the environment and sustainability

- New ways to reach and impact the new breed of ethical consumers

- Actual quotes from consumers and what they feel the country should do to be more sustainable

- ...And much more

TABLE OF CONTENTS

U.S. SUSTAINABILITY CONSUMER TRENDS DATABASE OVERVIEW

DEFINITIONS OF GROUPS

INTRODUCTION

OVERVIEW: TRENDS IN SUSTAINABILITY

NATURAL MARKETING INSTITUTE'S SUSTAINABILITY SEGMENTATION

Sustainability Segmentation Overview

Sustainability Segmentation Model Methodology

Five Distinct Sustainability Segments

LOHAS Consumer as Environmental Steward

Sustainability Path to Purchase

Sustainable Mainstream Overview

Shifts in Segment Composition

Leader and Followers Profile

Early Adoption among Leaders and Followers

Personal Sacrifice for E-Protection among Leaders and Followers

Differentiating Attitudes among Leaders and Followers

The LOHAS Consumer Profile

The NATURALITES Consumer Profile

The DRIFTERS Consumer Profile

The CONVENTIONALS Consumer Profile

The UNCONCERNEDS Consumer Profile

Demographic Summary Across Segments

CONSUMER ENGAGEMENT

Views on Consumer Engagement

Personal Responsibility for the Environment

Importance of Living Sustainably

Impact of Sustainability on Purchase Decisions

Growth of Environmental Concerns

Personal Sacrifice for E-Protection among Generations

Self Perceptions of Being "Green" and "E-informed"

Participation in Sustainable Behaviors

Minimizing Personal Impact on Global Warming Trended

Consternation Regarding Environmental Involvement

Perceived Leaders in Environmental Protection

Perception of Which Groups Need to Do More

Trust in Groups to Protect the Environment

PLANETARY HEALTH

Views on Planetary Health

Ratings of Aspects of the Environment

Concern for Global Warming

Perceived Causes of Global Warming

Perceptions of Decreasing Biodiversity

Consumers' Environmental Concerns

Perceived Causes of Decreasing Biodiversity

Perceptions of the Toxin - Disease State Connection

Concern Regarding Water

Consumer Perspective of Issues Which May Destroy the Planet

Concern over Earth's Ability to Sustain Life

PLASTIC, PACKAGING AND RECYCLING

Views on Plastic, Packaging and Recycling

Environmental Impact of Product Life Cycle Stage

Recycling Frequency

Attitudes about Over Packaging

Attitudes about Packaging Used for Shipping

Skepticism Regarding Recycling

Environmental Friendliness of Specific Materials

Environmental Friendliness of Convenience Plastic

Concern Regarding Plastic in the Ocean

Interest in Companies' Stance on Plastic

Preference for Non-Plastic Alternative Packaging

Consumer Desire for Less Plastic Use at Stores They Shop

Interest in "Refill" Stores

Preference for Less Plastic at Fast Food and Convenience Stores

CONSUMER PACKAGED GOODS

Views on E-Friendly Consumer Packaged Goods

Consumer Preference for Sustainable Purchases

Preference for Sustainable Purchases by Generation

Parameters of Quality, Convenience and Price Toward E-Friendly Purchase

Barriers to Environmental Purchases

Concern about Chemicals in Consumer Products

Concern about Chemicals Contaminating Waterways

Interest in Environmentally-Friendly Versions of Various Categories

Monitoring for Chemicals on Labels

Chemical Monitoring by Category Users

Importance Ratings of Household Cleaning Product Attributes

Growth in Importance of Household Cleaning Product Attributes

Willingness to Pay a Premium for Household Cleaning Product Attributes

Awareness of Unsustainable Sourcing by Tissue Brands

Importance Ratings of Personal Care Product Attributes

Growth in Importance of Personal Care Product Attributes

Willingness to Pay a Premium for Personal Care Product Attributes

Willingness to Pay 20% More for Sustainable Products

ETHICAL EATING

Views on Ethical Eating

Trended Product Launches with an Ethical Claim

Ethical Food Choices

Increased Use of Ethical Foods

Willingness to Pay a Premium for Ethical Food

Growth in Importance of Ethical Food Claims

Preference for Sustainable and Regenerative Agriculture

Avoidance of Toxins

Belief in Organic Food Attributes

Reasons for Meat Reduction

Meat Reduction for Environmental and Humane Reasons

Growing Importance of Humane Animal Treatment

Interest in Lab-Grown Meat

Efforts to Eat More Plant-Based Protein

Positive Perceptions of Plant-Based Protein

Consumer Desire for Sustainable Shopping Experience

INFLUENCING YOUR CONSUMER

Views on Companies' and Corporations' Role in Sustainability

Importance of a Company's Sustainable Platform

Interest in a Company's Social and Environmental Initiatives

Skepticism of Companies' Environmental Initiatives

Consumer Actions to Determine Companies' Environmental Initiatives

Value of Certifications and Seals

Growth in Recognition and Impact of Seals

Sources of Influence on Sustainable Purchase

Impact of a Company's Sustainability Initiatives

Skepticism of Green Labeling

Say-Do Gap Understanding

How to Successfully Communicate to Your Target

Consumer segments in the general population exhibit various shades of ‘green’ based on their levels of environmental and sustainable engagement. While some consumers have ‘deep green’ consciousness, there are varying levels among consumers within the American population.

The consumer segment within the population which is considered the ‘greenest’ segment is the LOHAS (Lifestyles Of Health And Sustainability) consumer who is integral in helping to drive sustainability into the mainstream. Other segments within the population also hold ‘green’ attitudes and participate in ‘green’ behaviors but their motivations are differentiated.

By understanding the consumer segment’s orientation, organizations are better equipped to determine how to target the most optimal segment with the most relevant marketing strategies.

SUSTAINABILITY SEGMENTATION MODEL METHODOLOGY

Development of Natural Marketing Institute's unique and proprietary segmentation model began with evaluating over 170 different attitudinal and behavioral variables, later narrowed to approximately 15. A k-means clustering method was used. Cluster centers were defined as dense regions in the multivariate space based on a k-means segmentation of the attitudinal variables from Natural Marketing Institute's Sustainability Consumer Trends Database survey.

This segmentation can be used to identify and predict segment membership as part of a quantitative extrapolative analysis of future consumer behavior.

5 Unique Segments: each segment is mutually exclusive and is designed to have the maximum differentiation between consumer groups and the maximum homogeneity within each consumer group. The predictive accuracy is high at 86%.

The segmentation has been overlaid on third-party data sets such as Nielsen’s Homescan and can be used through Natural Marketing Institute in custom/primary qualitative or quantitative research.

DEFINITIONS OF GROUPS WITHIN THE REPORT

GP – General Population U.S. Adults 18+

iGen – born 1998 – 2001 (Ages 18-21)

Millennials – born 1977-1997 (Ages 22-42)

Young Millennials – born 1991-1997 (Ages 22-28)

Older Millennials – born 1977-1990 (Ages 29-42)

Gen X – born 1965-1976 (Ages 43-54)

Boomers – born 1946-1964 (Ages 55-73)

Matures – born 1900-1945 (Ages 74+)

E-friendly Lawn – Purchased environmentally-friendly lawn/garden products in past 12 months

E-friendly Baby – Purchased Environmentally-friendly baby wipes/diapers in past 12 months

GMO-free F/B – Purchased GMO-free foods/beverages in the past 3 months

Org F/B – Purchased organic foods/beverages in the past 3 months

Natural/Org PC – Used natural/organic personal care products in past 6 months

Plant-based dairy – Purchased plant-based dairy products in the past 3 months

Natural HH Cleaning/Laundry Prod – Purchased natural household cleaning or laundry products in past 12 months

Statistically Significant Differences: Throughout this report, statistically significant differences between mutually exclusive consumer segments (using t-tests) are identified with capital letters. These tests are conducted at the 95% confidence level.

Indices: Indices are used throughout this report to compare consumer groups. An index is useful for the purpose of quick comparison and is a ratio of one piece of data to another. For example, if 22% of Consumer Group A use CFL’s, and 60% of Consumer Group B use CFL’s, then the index of Consumer Group A to Consumer Group B is: (60/22) x 100 = 272, which means that Consumer Group B is roughly 2¾ times more likely to use CFL’s than is Group A.

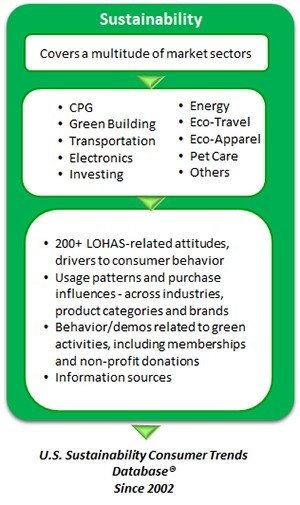

U.S. SUSTAINABILITY CONSUMER TRENDS DATABASE® (SCTD) OVERVIEW

Scope:

- Quantifies the size of the consumer market for environmentally and socially responsible products and services

- Measures the importance of environmental and societal issues as well as corporate social responsibility

- Explores environmentally conscious behavior

- Determines consumer usage of sustainable products and services and quantifies purchase criteria

- Annual tracking study in U.S. since 2002 and globally since 2005

Report Methodology:

- 3,000 U.S. adults in 2019, nationally projectable to the U.S. adult population and accurate at the 95% confidence level to +/- 1.2%

- Conducted online 4th Qtr. 2019

- Report released March 2020

Natural Marketing Institute Databases:

- U.S. Trending since 2002 and Globally since 2005

- Conducted in 23 countries; 150,000+ global consumers interviewed

For more information, kindly contact Steve French.